“The paradox of speculation is that it can often look most attractive just when it is most dangerous.”

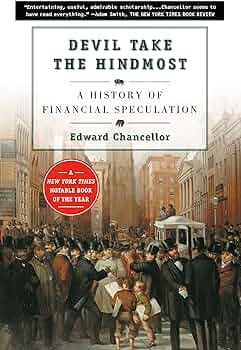

Devil Takes the Hindmost: A History of Financial Speculation” by Edward Chancellor is a comprehensive exploration of the history and nature of financial speculation from ancient times to the late 20th century. The book delves into various speculative manias, bubbles, and crashes throughout history, examining their causes, development, and consequences. It covers episodes like the South Sea Bubble, the Tulipmania in Holland, the Wall Street Crash of 1929, and the Japanese asset price bubble in the 1980s.

Here are five major lessons from the book:

- The Cyclical Nature of Speculation: Speculative bubbles tend to follow a cyclical pattern, often driven by easy credit and overly optimistic investment prospects. These cycles of boom and bust have been a recurring theme in financial history.

- The Role of Human Psychology: Human emotions like greed, fear, and herd mentality play a significant role in financial speculation. Investors often get caught up in the euphoria of rising markets, disregarding fundamentals and rational decision-making.

- The Impact of Government Policy and Regulation: Government policies, including monetary policy, regulation, and intervention, have a significant impact on financial markets. Sometimes well-intentioned policies can inadvertently fuel speculative bubbles.

- The Importance of Market Fundamentals: Over the long term, market prices tend to reflect underlying economic fundamentals. Speculative excesses often lead to severe corrections when reality catches up with investor expectations.

- The Dangers of Leverage and Debt: High levels of leverage and debt can amplify the boom and bust cycle, leading to more severe financial crises when bubbles burst.

Here are ten interesting ones from “Devil Takes the Hindmost”:

- “The desire of gain, in which mankind as a whole is embarked, is infinite.”

- “Speculation is as old as the hills.”

- “In every bubble there is a point beyond which speculation becomes dangerous.”

- “The financial memory is very short.”

- “In the wake of every great bubble comes the inevitable reckoning.”

- “The markets have a language of their own, which the prudent investor needs to understand.”

- “The paradox of speculation is that it can often look most attractive just when it is most dangerous.”

- “Government intervention in markets, though well-intentioned, often has unintended consequences.”

- “The collective madness of the market can persist longer than you can remain solvent.”

- “Every speculative bubble is a reflection of a profound human urge, the desire to get rich quickly and with minimal effort.”