Disclaimer:

Before following any of the advice provided in this article, it is important to note that everyone’s financial and tax situations are unique. The information provided in this guide is for general educational purposes only and should not be taken as legal, financial, or tax advice. If you have specific questions about your own situation, it is always advisable to speak with a qualified lawyer, accountant, or tax advisor. These professionals will be able to provide you with personalized advice that is tailored to your individual needs and circumstances. It is your responsibility to ensure that you are fully informed and compliant with all applicable laws and regulations, and we recommend seeking the help of a professional if you have any doubts or concerns.

Introduction

Investing in UK property through a limited company can offer a number of benefits for investors. These benefits include tax advantages, protection of personal assets, and increased flexibility in terms of financing and management of the property. However, there are also a number of considerations that investors should take into account before making the decision to invest in property through a limited company.

One of the main advantages of investing in UK property through a limited company is the potential for tax savings. Limited companies are subject to corporation tax on their profits, which is currently set at 19%. This is lower than the highest rate of capital gains tax, which is currently 20%. By holding the property in a limited company, investors may be able to reduce the amount of tax they pay on their profits.

Another advantage of investing in UK property through a limited company is the protection of personal assets. When a property is held in a limited company, it is considered a separate legal entity from the individual owner. This means that if the company were to face financial difficulties or be sued, the owner’s personal assets would not be at risk.

In addition to these benefits, investing in UK property through a limited company can also offer increased flexibility in terms of financing and management. Limited companies can more easily raise funds through the sale of shares, and can also bring on additional investors or partners. They can also be more easily managed, as the company’s directors can make decisions about the property without the need for the consent of all shareholders.

However, it is important to note that investing in UK property through a limited company also comes with a number of considerations. These include the potential for increased administrative burden, as limited companies must file annual accounts and returns with Companies House. There may also be additional costs involved in setting up and maintaining a limited company, such as legal and accounting fees. It is also important to consider the fact that some mortgages may not allow the property to be used as a primary residence, and living in a property that is owned by a limited company can also result in the individual incurring a benefit in kind.

One of the main considerations when it comes to living in a property that is owned by a limited company is the issue of mortgages. Some mortgage lenders may not allow a property that is owned by a limited company to be used as a primary residence. This means that if you are planning to live in the property, you may need to secure a mortgage from a lender that allows for this type of arrangement. It is important to carefully research the terms of any mortgage that you are considering and to make sure that it allows for the property to be used as a primary residence.

Another consideration when it comes to living in a property that is owned by a limited company is the issue of benefit in kind. A benefit in kind is a non-cash benefit that an individual receives as a result of their employment or as a shareholder in a company. In the case of a property that is owned by a limited company, the individual may be considered to be receiving a benefit in kind if they live in the property rent-free or at a reduced rent. This benefit would be subject to income tax and national insurance contributions.

How to take money out of a UK property investment company

When it comes to taking money out of the company, there are a few different options available. One option is to pay yourself a salary as a shareholder and director of the company. This salary would be subject to income tax and national insurance contributions, but it may be lower than the tax that would be due on the profits of the company. Another option is to pay a dividend to the shareholders of the company. Dividends are subject to a different tax rate, which is currently 7.5% for basic rate taxpayers, 32.5% for higher rate taxpayers, and 38.1% for additional rate taxpayers.

If you are looking to reinvest the profits from the sale of the property in order to buy more properties, there are a few different options available. One option is to use the profits to buy more properties in the same limited company. This can help to further reduce the overall tax burden, as the company would be subject to corporation tax on the profits rather than individual taxpayers. Another option is to set up a new limited company to hold the new properties. This can offer the same benefits of tax savings and protection of personal assets as the original company, but it may also involve additional setup and management costs.

How to transfer a company from an individual to a company?

Transferring a property from an individual to a company can offer a number of benefits, including tax advantages and protection of personal assets. However, it is important to carefully consider the costs and process involved in making the transfer. In this article, we will explore the steps and costs involved in transferring a property from an individual to a company in the United Kingdom.

The first step in transferring a property from an individual to a company is to set up the company. This can be done through Companies House, and the process typically involves filing articles of association, registering the company’s directors, and issuing shares to the shareholders. The cost of setting up a limited company varies, but it typically ranges from £12 to £40, depending on the type of company being set up and the services being used.

Once the company has been set up, the next step is to transfer the property to the company. This can be done through a process called a “transfer of assets”. The individual will need to transfer the ownership of the property to the company in exchange for shares in the company. The transfer will need to be recorded in a transfer of assets agreement, which should be signed by both the individual and the company.

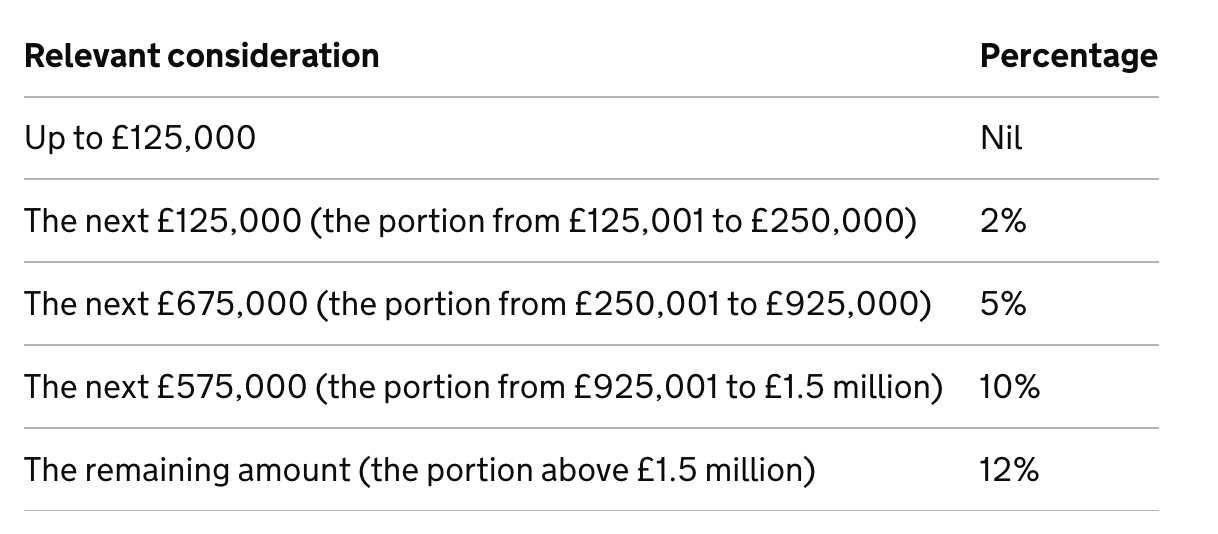

The transfer of assets will typically be subject to (SDLT). The amount of SDLT that is due will depend on the value of the property being transferred and the rate that applies to the transaction. For residential properties, the rates are as follows:

More info is here.

In addition to SDLT, there may also be other costs involved in transferring a property from an individual to a company, such as legal and accounting fees. It is important to carefully consider all of the costs involved in the process and to budget accordingly.

Once the transfer of assets has been completed, the property will be owned by the company. The individual will then be a shareholder in the company and may be entitled to receive dividends or a salary from the company, depending on their role and the terms of the company’s articles of association.

Overall, transferring a property from an individual to a company can offer a number of benefits, but it is important to carefully consider the costs and process involved in making the transfer. It may be advisable to seek the advice of a financial professional before proceeding with the transfer.