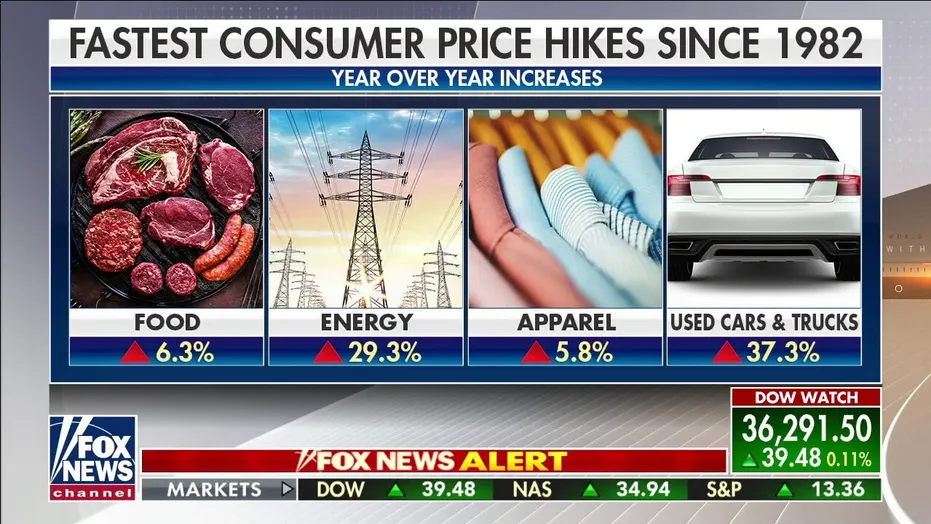

Since 2020, the US has put in unprecedented spending in the economy. The inflation rate in US is now 8.5% which is one of the highest rates for the last 40 years. If you have money in the bank, it is losing its value at a rate of 8.5% per year

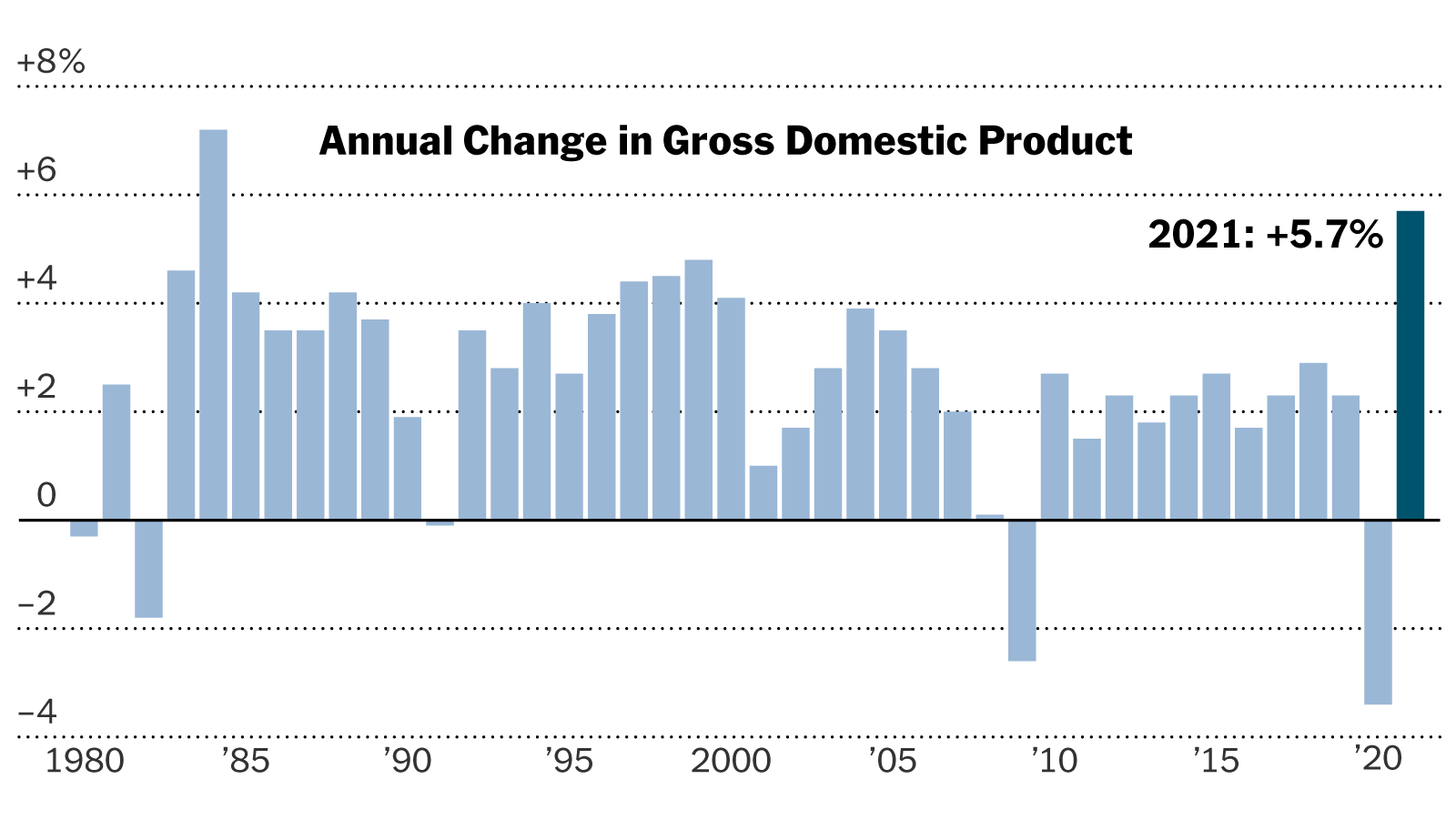

The US GDP has fallen by 1.5% in the first quarter, the stock market has also fallen consistently, and people are expecting a recession. This is partly because of inflation, and people are expecting interest rates to rise which will further dampen GDP growth, and also because of the supply chain issues, the war in ukraine, and lockdowns in China. People are concerned about stagflation which is high inflation, low GDP growth, and high unemployment.

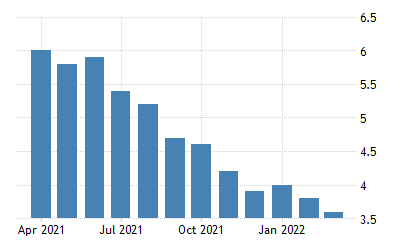

However, my thoughts are that the US economy seems the be strong. The unemployment rate is very low the best it has been for a long time,

and the US consumer spending is strong. A big reason for the fall in GDP is actually because imports rose, and exports decreased which are both a sign that the economy is actually strong. A portion of the imports (15%) is from oil related. But it’s impossible to know what will happen as interest rates rise fr0m 0-2% in the coming few months.

However, I believe it’s always best to consistently invest on a regular basis, then when the economy goes down there are more opportunities. Because of the current inflation, and the fall in the stock market, it could be a great time to invest. That’s why I’m consistently buying.

So what are the best investments during this time?

- Cryptocurrencies such as bitcoin don’t lose their value because there is a finite number of them. But at the same time they’re highly speculative. They could all possibly go to 0 at some point, but on the other hand they could replace the fiat money system and 100x. It might be wise to put some portion of money in cyrptocurrencies.

- Gold is also a safe place to put money because there is a more limited supply, and it can act as a hedge against inflation and challenging times. There are some people who say that cypto-currencies are the new gold, but if you look at the behaviour of crypto-currencies compared to gold and the stock market, it’s not clear if cryptocurrencies are as secure as gold. When the stock market has fallen, so too have cryptocurrencies, which means that they’re more speculative, and it might be better to invest in gold as a hedge against tough times. I particularly like Barrick which is a gold mining company. They also give dividends. Buying one of the world’s leading gold mining companies is a great way to invest in gold because the company will do well when the price goes up, and it’s also a productive asset which creates value, instead of buying gold which just sits there.

- My favourite stocks right now are related to 1) automation, 2) robotics, and 3) artificial intelligence. I think that this is a strong long term trend, and you can see all the changes happening in the world with COVID and supply chains that robotics and automation is only going to rise in the future. I like to invest in ETFs that are related to these areas such as ishares automation and robotics. One of the reasons why I like ETFs is because their weighting are continually adjusted each quarter depending on the performance of those companies.It’s the best way of capturing the trend and as new companies come into the market to compete and the sector grows, it will just push the overall ETF higher. It’s like warren buffet said that 100 years ago there were 200 car companies in US and now there are only a handful. On the whole, actually the investors hardly would have made money because of how many failures there were. It’s also extremely hard to know which ones are going to be the winners without doing lots of research, but if you bought the whole market then you could capture the overall benefit.

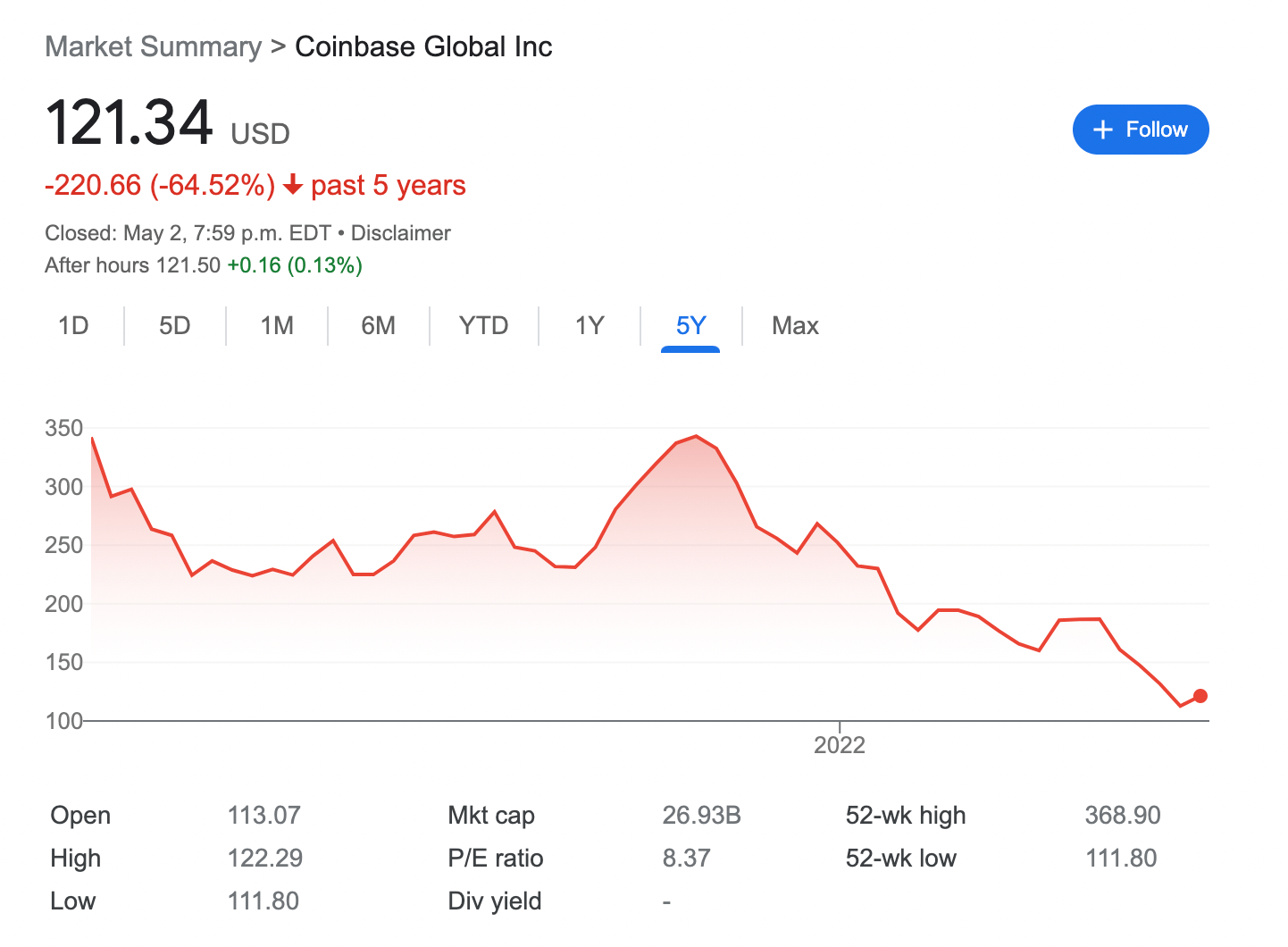

- There are also some interesting individual stocks such as Coinbase which has seen its stock price drop rapidly while the revenues and profits have been growing fast.