“Money equals business, which equals power, all of which come from character and trust.”

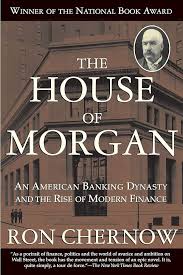

This book traces the history of the Morgan banking dynasty, from its roots in the 19th century to its role in shaping the landscape of modern finance.

You can get the book on Amazon here.

Chapters:

- The Baronial Age (1838-1913): Chronicles the rise of the Morgan empire, focusing on J. Pierpont Morgan’s consolidation of power and influence in banking and industry.

- The Diplomatic Age (1913-1948): Explores the Morgans’ adjustment to a new era of banking regulations and their role in international finance during two world wars.

- The Casino Age (1948-1989): Details the transformation of the Morgan banks in the face of technological advances, deregulation, and the rise of global finance.

About the Book

The House of Morgan is a meticulously researched and engagingly written saga of the Morgan banking dynasty. Ron Chernow masterfully weaves the complex story of how the Morgans shaped the financial world, navigating through wars, economic depressions, and regulatory changes. The book is not just a history of a banking family but a panoramic view of American and global finance. Chernow’s narrative is both informative and captivating, providing insights into the personalities and decisions that shaped the Morgan empire and, by extension, the modern financial landscape.

The book is divided into three main sections, each corresponding to a distinct era in the history of the Morgan banks.

The Baronial Age (1838-1913)

The story begins in the mid-19th century with the founding of the House of Morgan. The bank was initially established in London by George Peabody, but it was J. Pierpont Morgan, Peabody’s protégé, who transformed it into a financial powerhouse. This era saw the rise of J.P. Morgan as a dominant figure in American finance, using his influence to consolidate industries, bail out the U.S. government during financial crises, and establish a banking empire that operated with the power and authority of a central bank. Key events during this period include Morgan’s role in the creation of General Electric, his intervention in the Panic of 1893, and his orchestration of the 1907 financial crisis resolution.

The Diplomatic Age (1913-1948)

The second part of the book covers the period after J.P. Morgan’s death, when the bank had to adapt to a changing financial landscape marked by the establishment of the Federal Reserve System and the aftermath of World War I. During this era, the Morgan banks expanded their international presence and played a crucial role in financing post-war reconstruction in Europe. The book delves into the bank’s involvement in the Dawes and Young Plans for German reparations, its role in the creation of the Bank for International Settlements, and its participation in the financing of major infrastructure projects like the Panama Canal.

The Casino Age (1948-1989)

The final section of the book focuses on the transformation of the Morgan banks in the post-World War II era, as they navigated the challenges of decolonization, the Cold War, and the rise of new financial instruments and markets. This period saw the decline of the traditional merchant banking model and the rise of modern investment banking. The Morgans adapted to these changes by expanding into new areas such as securities underwriting, asset management, and corporate advisory services. The book concludes with the deregulation of the financial industry in the 1980s, which paved the way for the merger of J.P. Morgan & Co. with Chase Manhattan Bank in 2000, creating the modern JPMorgan Chase.

Throughout the book, Chernow provides detailed accounts of the key figures in the Morgan dynasty, their business strategies, and the political and economic contexts in which they operated. The narrative is enriched by insights into the personalities and rivalries that shaped the bank’s history, as well as the broader trends in finance and geopolitics that influenced its development.

Interesting Lessons:

- The importance of reputation and trust in the banking industry.

- The impact of regulatory changes on financial institutions.

- The role of finance in shaping national and global history.

Interesting Quotes:

“Banking is a very good business if you don’t do anything dumb.”

“A man always has two reasons for doing anything: a good reason and the real reason.”

“Money equals business, which equals power, all of which come from character and trust.”

“If you have to ask how much it costs, you can’t afford it.”

“Go as far as you can see; when you get there, you’ll be able to see farther.”

“No problem can be solved until it is reduced to some simple form.”

“I owe the public nothing.”

“Success can be built on a strong foundation of failures.”

“The first step towards getting somewhere is to decide that you are not going to stay where you are.”

“The wise man bridges the gap by laying out the path by means of which he can get from where he is to where he wants to go.”

Author: Ron Chernow is a Pulitzer Prize-winning author and historian known for his detailed biographies and histories of financial institutions. His other notable works include Alexander Hamilton, Washington: A Life, and Grant.

Related Books:

- Titan: The Life of John D. Rockefeller, Sr. by Ron Chernow

- The Warburgs: The Twentieth-Century Odyssey of a Remarkable Jewish Family by Ron Chernow

- The First Tycoon: The Epic Life of Cornelius Vanderbilt by T.J. Stiles

- The Power and the Money: Inside the Wall Street Journal by Richard J. Tofel

The House of Morgan offers a fascinating glimpse into the world of finance and the family that once stood at its center. It is an essential read for anyone interested in the history of banking and the evolution of the global financial system.